Last week we learned some tips on how to open an account with a Swiss bank and found out a few specifics, like what currencies you can keep there, what documents you need, and what the minimum deposit is. Today we will continue our research and I’m ready to answer the following 6 questions that might be of interest to you.

What will happen to those who break the law of a Bank Secrecy? How confidential is information about opening a Swiss bank account?

Federal Acts on banks and savings banks (Bundesgesetz über die Banken und Sparkassen) lay down the obligation for banks to keep customer information confidential. Current and former employees of banking institutions will be criminally liable if they disclose confidential information (Swiss Penal Code).

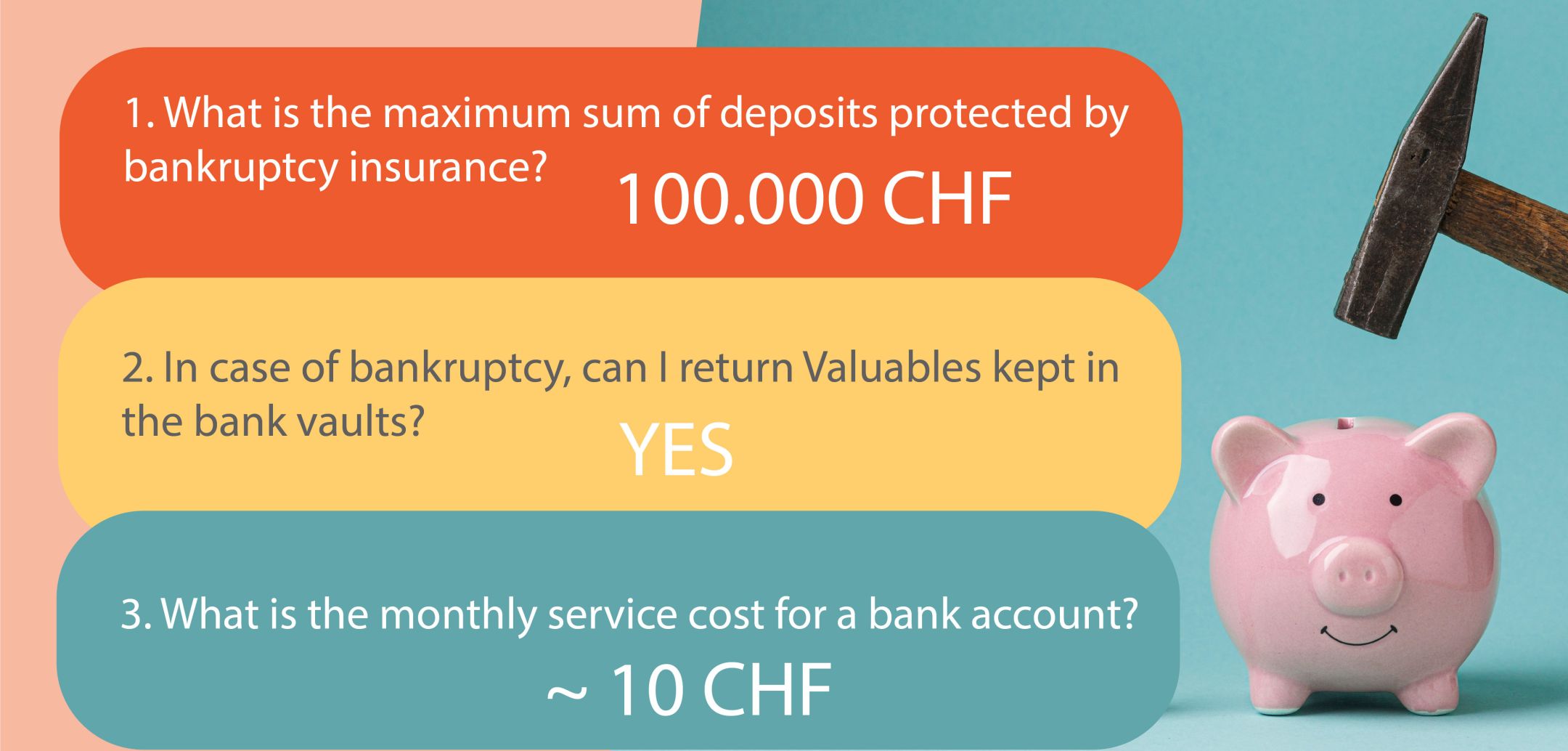

How high is the safety of funds in a Swiss bank account?

Switzerland is distinguished by one of the strictest legislation regarding the stability of the banking system. Banks in Switzerland, in comparison with “colleagues” in the U.S. and the EU, have coped well with the global financial crisis. The reform of the implementation of the rule “too big to fail” has placed Switzerland in first place in the world on the level of its own reserves of large banks.

Swiss banking law also provides other guarantees of the safety of funds in the account. In case the bank goes bankrupt, deposits of up to CHF 100,000 (up to CHF 30,000 until December 22, 2008) per person will fall into Group 2. This means that the payout of these claims precedes most other claims, so there is a dramatic increase in the likelihood that the account holders’ funds will be fully paid out.

Valuables (precious metals, cash, works of art, etc.) kept in the bank vaults when the bank goes bankrupt, are not included in the bankruptcy estate, i.e. remain in the ownership and are subject to return at the request of their owner.

Can I use a bank card linked to an open account?

All Swiss banks offer Mastercard, Visa, and American Express credit card services denominated in Swiss francs, euros, or dollars. For persons residing permanently outside Switzerland, there is often an obligation to keep a minimum amount in the account (usually a monthly card withdrawal limit). As an alternative to credit cards, the client may be offered a Maestro debit card.

How much does it cost to maintain an account at a Swiss bank?

Swiss banks do not charge for opening an account. For account management, bank transactions (bank transfers, credit card service, etc.), as well as administrative costs (e.g. correspondence) are subject to fees, which vary from bank to bank and, ultimately, are prescribed in the contract on an individual basis.

For example, in UBS, servicing an average account of an individual will cost from 10 CHF per month.

The interest due, depending on the amount of the deposit, maybe less than the cost of maintaining the bank account.

Is interest due on the amount deposited?

In theory, all Swiss banks should pay interest on the amount deposited. Interest on a savings deposit is higher than on a private deposit. Since a foreigner can open an account in a Swiss bank also for investment purposes, the rate of return can be higher than a normal deposit, but the risk of an investment account increases significantly.

Since there is bank secrecy in Switzerland, a tax of 35% is charged on the interest and not on the amount of the account. The holder of the deposit is entitled to a refund of this amount when completing a tax return in Switzerland. In the situation of negative interest, this tax is not levied, as there is no object of taxation.

Can I close my Swiss bank account at any time?

A private deposit can be closed immediately upon receipt of the appropriate application from the account holder. In the case of a savings deposit, the agreement with the bank may stipulate a waiting period of 3, 6, or 12 months from the receipt of the application to close the account. The mechanisms for closing an investment account at a Swiss bank are stipulated in the agreement on an individual basis.

If you want to check prices for common service plans of Swiss Banks visit the websites of UBS, Credit Suisse, Raiffeisen, and PostFinance.

That’s all the financial news from Switzerland so far! Till next Friday and the next post about money!

Check out my previous posts about Swiss Bank accounts here:

1. Why has Switzerland become an island of financial paradise?

Very nice to know! That’s crazy service plan – 10 CHF per month? In Russia we pay less per year!

Thank you. As every bank has a different policy, fees might vary. If you are interested in free student accounts check out PostFinance.