Hi! My name is Gavkhar, and I have been studying in Switzerland recently. Besides the Swiss Alps, watches, cheese, and chocolate, one of the most popular topics that come to mind when someone talks about Switzerland are Swiss banks. Banking in Switzerland has long characterized this country abroad as a safe haven for money on favorable terms. Many of my friends who are also foreign students ask the same question:

Why has Switzerland become such a popular place for banking and withdrawing money into the protected zone?

The answer lies in the long history of banking secrecy, customer privacy in Switzerland, and the high level of service. To understand the ins and outs of the Swiss banking system, I invite you to explore the most relevant topics in my blog about Swiss banks.

So, why exactly has Switzerland become such a popular place for banking services and withdrawal of money to the protected zone?

It’s all about Swiss Banking Secrecy Laws

For many years, Switzerland had banking laws that forbade banks in the country to reveal account holders to foreign government agencies or anyone else. However, this has changed in recent years, as bank secrecy has been relaxed due to constant pressure from various countries to disclose account holders who may be suspected of tax evasion.

Swiss laws stipulate that it is a crime for a banker to disclose information about the owner of the account. Swiss banking laws also protect bankers from any lawsuits initiated by foreigners, criminal charges, or extradition requests for failure to disclose customer information.

So is Switzerland really covering up even rich criminals?

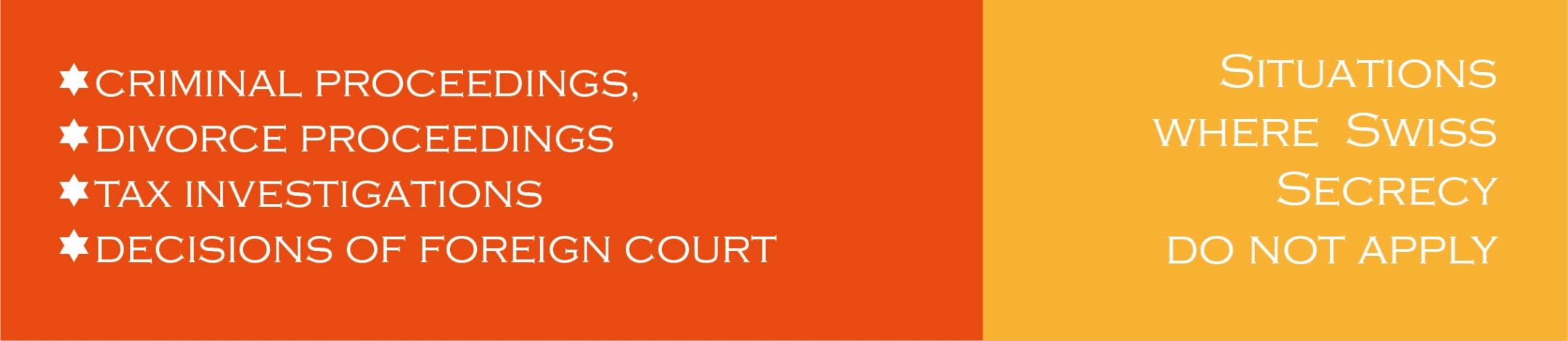

Thank God, it’s not all that bad. There are situations where secrecy does not apply. Client confidentiality is lost only when the account holder commits acts contrary to Swiss law, including the transfer of money offshore or tax evasion.

Disclosure of bank account holder information may also occur when criminal proceedings, divorce proceedings or tax investigations are pending against the account holder. The Swiss Banking Association is quite clear that it is easy to open a Swiss account and get service of money, but it is illegal and punishable to use such wallets as a refuge for illegally obtained wealth.

In addition, Swiss banks willingly cooperate with foreign governments on issues such as terrorism and fraud. Foreign court decisions (e.g. from the U.S.) in cases involving civil and criminal offenses can also force Swiss authorities to disclose information about the defendant’s bank account.

Thus, Swiss banks do not provide protection for their clients who are violators of the law in a particular country and are subject to prosecution.

However, this does not make Swiss banks less attractive to people who have no problems with the law in the countries where they live and work. If you are one of those, then regardless of the bank secrecy situation, you will be interested to know what Swiss bank accounts are, how much it costs to service such an institution, how to transfer money to the account and how to open one.

Subscribe to my blog to find out in the next posts:

- How much does it cost to open an account in Switzerland and how expensive is it to maintain a Swiss account for a non-resident?

- How to put money into a Swiss bank account?

- How to open an account in Switzerland remotely?

See you soon! I wish each of my readers’ good luck!