When I first arrived in Switzerland, I had a remarkable experience that made me think deeply about the financial structure of the country and, in fact, I started this blog about money. When I went to the bank to open an account, I had mixed feelings when I found out that there was a monthly fee to be paid. And not just for the account – for everything! For the Visa card, for using ATMs, for transactions with any foreign country. Wait, what is this nonsense? – I thought. – Why should I pay the bank for depositing my money? Should not the bank be paying me for using my money? What is the praise of the Swiss system? Why do all the world’s rich keep their money in Swiss banks, if there is an enormous risk of losing it? Of course, being a thoroughgoing person, I researched why the rich consciously choose to lose their money in Swiss banks. And that means it is time to find out!

The situation where you pay to keep money in the bank is called negative interest.

Many people find this phenomenon absurd and wonder why people bring their money to such banks. You would find this even more ridiculous if you knew that this is the scheme used by all banks in Switzerland, which is most popular with all the world’s wealthiest people.

It would seem, who would need it when you can put your money in a Russian or even an American bank and get a positive return instead of a negative one?

There must be some catch!

I found one simple explanation for this catch, starting with an anecdote.

This illustrates the old economic principle of no-arbitrage: if an opportunity arises to gain by moving a resource from one use to another, that opportunity will quickly disappear at the expense of the people who take advantage of it. So, the opportunity that has existed for years for those who keep money in a Swiss bank to gain is an illusion. And, if some additional considerations are taken into account, this negative percentage is not such a bad thing.

What conclusions can be drawn?

- Inflation.

We are used to people putting money in the bank in order to at least keep it. However, even if you deposit your money at a high-interest rate, the real value of the Money falls over time if inflation exceeds the interest rate. Thus the service charge for keeping money in the bank in countries with an unstable national currency is charged by the state. Depreciation of the national currency is the same negative interest, only charged regardless of where you keep your money.

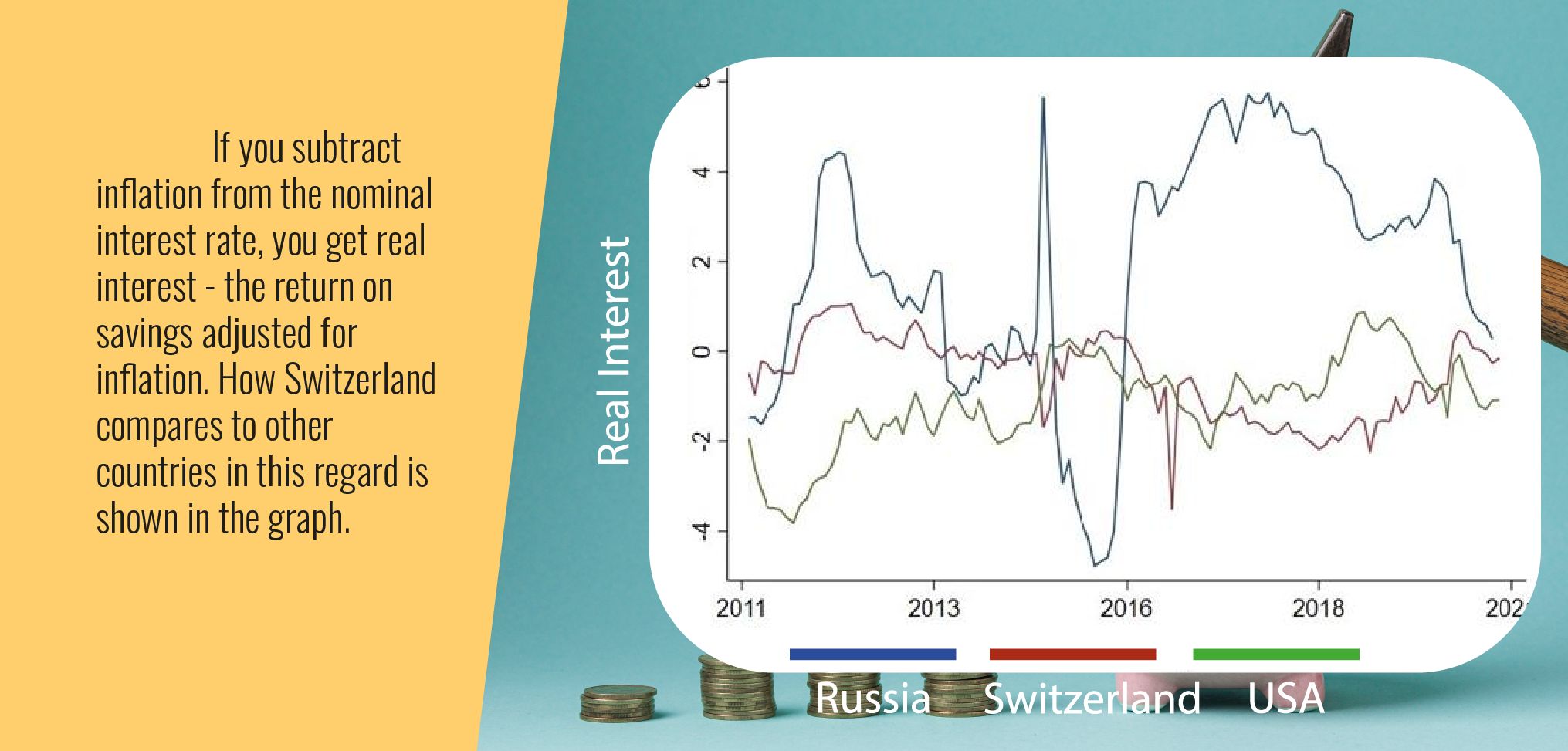

The real return on savings adjusted for inflation can be found by subtracting inflation from the bank interest rate. Switzerland’s performance on this issue compared to other countries is shown in the chart below.

https://www.elibrary.imf.org/view/journals/002/2021/130/article-A001-en.xml

https://www.elibrary.imf.org/view/journals/002/2021/130/article-A001-en.xml

Whereas in the first graph Switzerland was clearly losing out to Russia and the USA in terms of bank deposit yields, now Switzerland already looks better than America on average and in some years even better than Russia. The reason is simple: While Russia and even the USA have had positive inflation for the last ten years and are quite high, Switzerland has had zero inflation for the same period, often turning into deflation. In contrast to other currencies, the franc has gained in value over time instead of depreciating. Therefore, real bank deposit yields in Switzerland are higher than in the US.

- Currency changes.

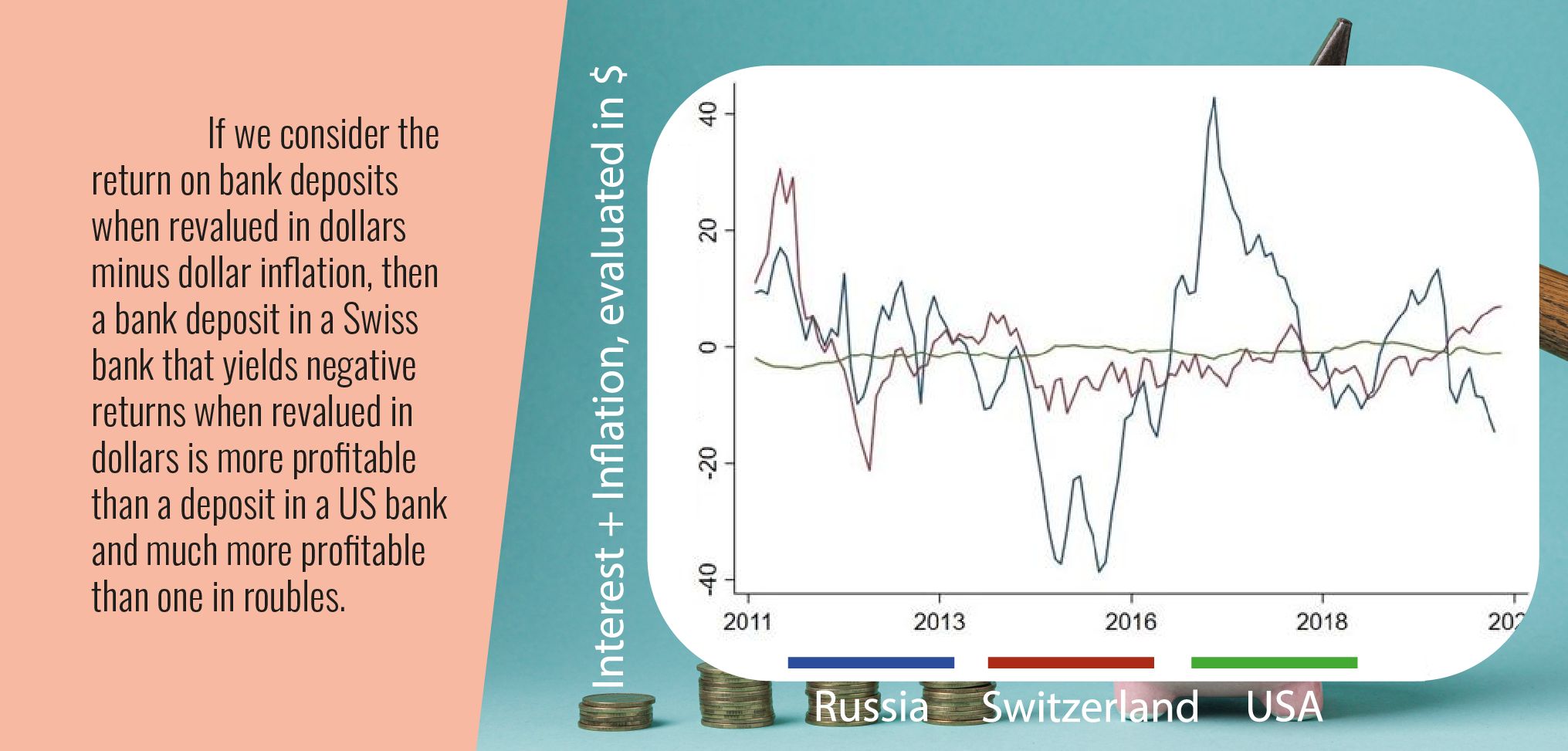

There’s another nuance to consider, related to changes in the value of currencies. What are the returns on bank deposits when they are revalued in dollars minus the dollar inflation? This can be seen in the chart below.

https://www.banki.ru/products/currency/chf/

https://www.banki.ru/products/currency/chf/

Now we can already see that he who was last became first. This year a bank deposit in a Swiss bank which brings a negative yield when revalued in dollars turns out to be more profitable than a deposit in a US bank and much more profitable than our bank deposit and that is while the latter gives a positive yield.

If you add to these considerations the reliability of Swiss banks, it is understandable why millionaires open deposits in Swiss banks, especially if there is a lot of money involved in the long term.

Interested in more details about money in Switzerland? Read all my previous posts here:

Why has Switzerland become an island of financial paradise?

How to open an account in a Swiss bank? Part 1

How to open an account in a Swiss bank? Part 2

What Swiss know about money: Where does the money come from?–Street Survey.

Which Swiss Bank is the best one?