Do you remember when Visa and Mastercard appeared? How many of you believed in that system from the very beginning? Now we have the same revolution with cryptocurrency. As time goes on, more and more people are becoming comfortable with digital assets. The average person sees that digital currency like a potential source of revenue and a legitimate payment method. Bitcoin, the largest most popular cryptocurrency out there on the market, it is also the transfer of value using digital currency.

https://www.coinbase.com/price/bitcoin

Two years ago today, Bitcoin hit its highest price ever, reaching $19,783. With the start of media dust on the coronavirus and speculation about the downturn in the world economy. Bitcoin had a fall on March 13th to 3,670 CHF. The next day it started to rise, which confirms the substantiality of the currency and could see a positive performance during a possible bout of global deflation if it acts not just as an investment asset, but as a medium of exchange and a perceived haven like gold.

https://www.coinbase.com/price/bitcoin

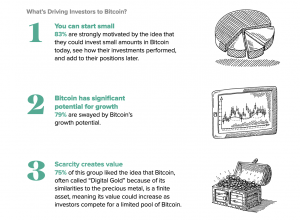

People who are invested in cryptocurrency should know and trust the technology behind it. Another thing they believe that the price will ultimately rise regardless of the ups and downs that occur along the way. Two types of people who are trading with Bitcoin. Bitcoin investors tend to hold all the currency long-term. The hold is a popular term in the Bitcoin community that was born out of a typo of the word hold an old 2013 post in the bitcoin talk.

Bitcoin traders buy and sell Bitcoin in the short-term whenever they think a profit can be made. Traders view Bitcoin as an instrument for making profits sometimes they do not care about the technology or the ideology behind the product they’re trading. But why are so many people looking to trade cryptocurrencies, especially Bitcoin?

All this stuff here is a few of the reasons the first Bitcoin is very volatile in other words you can make a nice amount of profit if you manage to correctly anticipate the market. Unlike traditional markets, Bitcoin trading is open 24/7. Most traditional markets such as Stocks & Commodities has opening and closing time. With Bitcoin, you can buy and sell whenever you please. Bitcoins’ unregulated landscape makes it relatively easy to start trading.

Without the need for long identity verification processes but all traitors are not the same and here are different types of trading methods:

Day trading is specifically buying and selling financial instruments within the same trading day, such that all positions are closed before the market closes for the trading day. Traders who trade in this capacity with the motive of profit are therefore speculators. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies.

Scalping is a day trading strategy that a lot of people are talking about. Scalping attempts to make substantial profits on small price changes and it is often referred to as picking up pennies as fast as possible on extremely short-term. It is based on the idea that making small profits immediately limits risk and create advantages for traders. They can make 100 trades in one day.

Swing traders try to take advantage of natural price movement. Thay enter the trade then they hold on until the movement dies out and take the profit they tried to see the big picture without constantly monitoring their computer screen. Swing traders can open a trading position and hold longer than a day trading position, but shorter than buy and hold investment strategies hold it open for weeks or months until they reach the desired.

Contrary to expectations, Bitcoin could see a positive performance during a possible bout of global deflation if it acts not just as an investment asset, but as a medium of exchange and a perceived haven like gold. Ever since its inception, Bitcoin has been dubbed “digital gold.” As the yellow metal, the cryptocurrency is durable, fungible, divisible, recognizable, and scarce. Bibliography

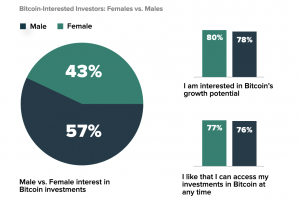

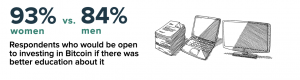

Grayscale and Q8 Research (2019), Investor Study. Retrieved from https://grayscale.co/bitcoin-investor-study-2019/

https://www.coindesk.com/why-global-deflation-may-not-be-bad-news-for-bitcoin