Covid-19 has turned the world upside down. Most people are working from home, are employed on short-time work or even have already lost their jobs. The economic consequences are enormous. On the one hand this uncertainty can lead to financially worries. On the other hand the lockdown can also end in an uncontrollable online shopping fever. Although you do not really need all of these things, online shopping might be a great pasttime at the moment. However especially in a crisis you should keep your finances in mind and focus on what is necessary and really brings value to you.

In the following I will help you with 4 simple steps on how to keep your money under control.

Step 1: Track your finances

If you want to have a better overview on what you are spending your money on, financial planning comes into play.

I know it sounds odd and you might be thinking about complex excel files or old-school housekeeping books. Well, that’s past history now. Today your mobile phone can function as your virtual budget planner. Several free apps make it way easier for you to track everything from your income, fixed costs, to expenses and even your savings for your retirement. (retire what?)

As there are plenty of similar applications on the market, they may all differ in functionalities and quality. In the beginning setting up your finance planner takes a little time and effort to enter all your budget data and categories. Therefore, to really know which app is suitable for you I would recommend taking enough time to evaluate each of them according to your needs. Most of the apps are free or offer a free trial period.

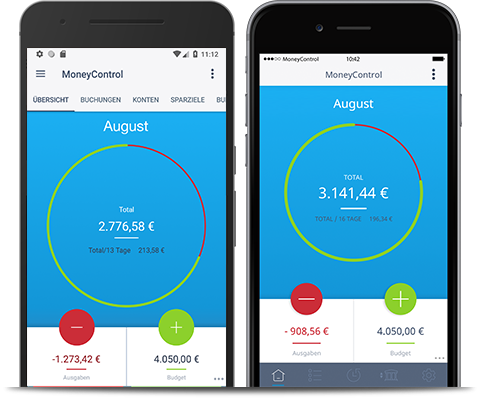

I’ve been using MoneyControl for a while now and I really like it. It is user-friendly and displays your money flow in a clear way. I still use the free version but for a little money you can upgrade to all the premium features with more advanced reports or syncing it to different devices.

With these helpful apps you might detect some cost traps e.g. expensive mobile phone subscriptions or fees for entertainment services like Netflix or Spotify.

There are several online comparison portals (Comparis, MoneyLand etc.) to check different providers with the same services to get the most out of your money. When it comes to entertainment services you might think about teaming up with your friends or family (or your ex ;)) to share one single account to reduce the costs.

Step 2: Selling your used goods through sales portals online

In one of my previous blogpost I gave you tips on how to declutter your home. You can either donate or sell your items. If you think that some items are too valuable to be given away for free and you want at least get a little return out of it, then you shall consider selling online.

The golden rule of selling online is to catch the buyers interest.

This works best by presenting your objects as attractive as possible. Remember, your potential buyer can not touch or examine the products in person and can only make a purchase decision based on your provided information.

Spot the difference below: Which item would grab your attention?

If you have successfully attracted a potential buyer to your offer it is then important to give a detailed description and also provide additional pictures about the product. If you do not put enough effort into this step it might seem that you have not looked well after the item being sold.

There is a huge variety of sales portals world wide. You shall focus on the ones in your area and surroundings. In Switzerland you could sell for example through Tutti, Ricardo, Anibis or Facebook Market Place.

For used clothes I recommend to read Anja’s interesting article to know more about how to give your clothes a new owner by selling through a range of second-hand stores in Switzerland.

Step 3: Plan your grocery shopping in advance

Especially now during lockdown as restaurants and bars are closed we tend to buy more food at the supermarket. Which is great because now many of us are cooking more often and might even enjoy it. However if we go shopping without a plan in mind we might end up doing impulsive purchases. The consequence is often that products will be forgotten in the fridge, are expiring and in the worst case will be thrown away untouched. In Switzerland 2.8 million tons of food is wasted yearly, whereas 95% could have been avoided. This is an awful lot and also a wasteful of money.

You have to find out what works for you and what is adaptable to your time schedule. One bulk purchase once a week would be more time efficient and also money saving than doing several little purchases day by day.

Before leaving the house make a plan of your meals for the week and write down all the ingredients which are needed. Then check which food you have at home, so you avoid buying twice and triple.

Probably the best tip ever (at least for me) never go grocery shopping when you are hungry. You then tend to overload your shopping basket and buy a lot, just to satisfy your cravings. An American study even found out that you are more likely to buy high calorie food like chips, chocolate or fast-food products. As a consequence the healthy foods like veggies and fruits often will be neglected.

Step 4: Small cattle also mess – Energy saving at home

Not only is it beneficial for the environment but also healthy for your pocket. At first it seems like that those standby devices do not have a huge impact, but in reality they are real power guzzlers.

According to Umweltnetz Schweiz an average 4-person household produces 670 kWh with stand-by devices per year. This equals costs of approx. 140 Francs per year.

Therefore try to unplug electric devices whenever they are not needed and also turn off the lights when leaving a room.

I hope these easy and simple tips were useful. Please let me know about your experiences or advices on how to save money to live a more minimalist lifestyle.

Photo by Micheile Henderson on Unsplash

Grate Article, thanks for this information

Dear Matar, thank you for your comment. Happy you liked the post.

Very helpful article, Stella!! I feel like your blog really helps “people” (me) organize their lives better! I’ve tried several financial tracking apps but didn’t like the hassle of having to register every single purchase each time. That’s why I’m currently thinking about signing up to Revolut, as I’ve heard they automatically categorize your spending so you get a better overview over your credit and debit finances. Do you have any tips for selling clothes specifically? How do you set them in scene successfully?

Hey Oli, thanks for your cute comment. Oh cool, thanks for telling me about Revolut. I will definitely check it out.

With clothes that is always a little trickier but what I think is helpful is to show how you would combine the piece of clothing you want to sell. Like this your potential buyer has already an idea on how to wear it and is then maybe more likely to buy it. Let me know if that worked for you.

Hey Stella, thank you for this post full of good advices! Especially during these weeks it feels like we are not spending so much money as we would normally do, and that’s the reason why sometimes I find myself browsing on Zalando…luckily I haven’t ordered anything yet. Instead I think i should use this time I have to declutter my wardrobe and see what can be reused / sold online 🙂 thanks for all the great tips!

Hey Vero, I know these online offers are tempting. Happy to hear that you have the strength to resist 😉 Your wallet will thank you for it and you will have more money available for things that really matter to you.

Hey Stella, I love your post! I like the fact that everyone can integrate your tips into everyday life. Especially the weekly shopping and the tip with the electricity are done so easily and quickly. Sometimes you just need a reminder, thank you very much for this!

Dear Anja, thank you for your comment. It always easier than done but to start with some first little steps might be helpful to get some awareness for the topic.

Hi Stella – the electricity tip is definitely something one can easily implement. For the finances I have been tracking mine with my e-banking app. If you are a customer of a Kantonalbank then you can use the financial assistant for free. As Olivier mentioned I also have Revolut which automatically categorize every amount spent and gives you an overview on which item you spend most money monthly. The only problem is that you cannot track cash spent within both apps and I think one has to adapt to only using one system, that’s why I mostly use revolut when traveling abroad.

Hey Stella, thanks for this useful advice! I should probably try this MoneyControl app out, because I feel I don’t have the situation under control, especially in these odd times. However, I can already confirm that planning grocery shopping in advance is a very good tip: it helps to reduce waste and as well I can avoid going to the supermarket daily.. especially during this lockdown I prefer to go there as less as possible.

So looking forward to the next blog post! 🙂

Hi Stella – I have never used Facebook Marketplace to sell or give things, because I do not use Facebook.

But my wife used https://trovas.ch to get some items for free or very cheap. It works really well.