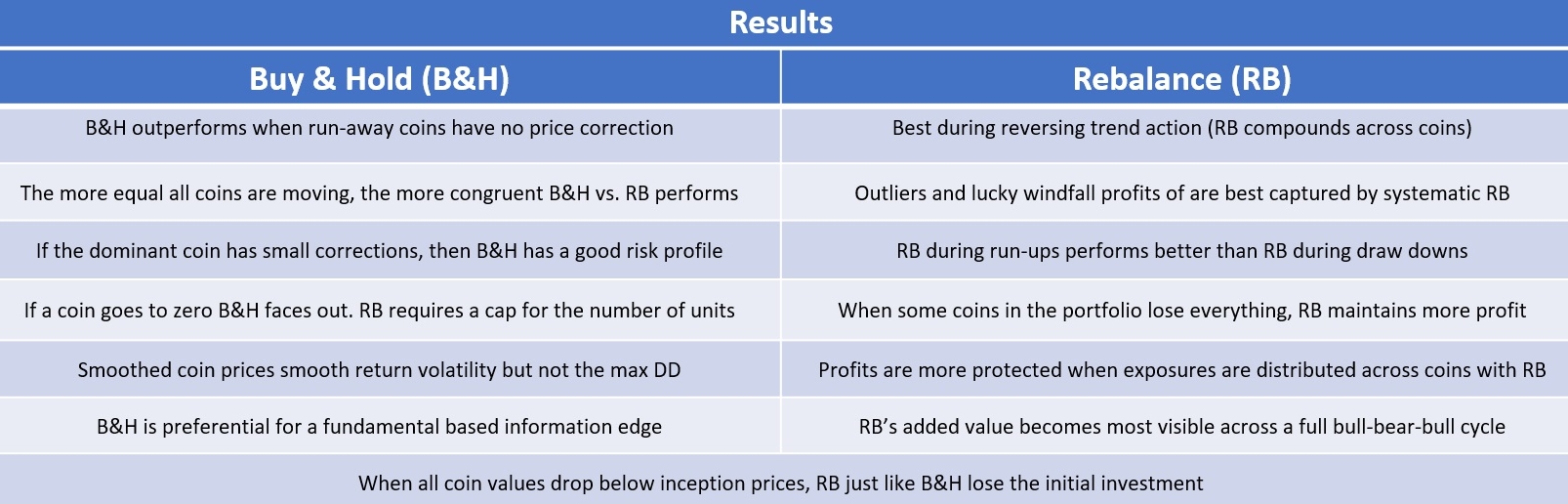

Crypto investors tend to Buy & Hold. Price rallies beyond 10’000% require one lucky pick turning coins into lottery tickets, including the risks of losing it all. In finance, these risks are reduced with rebalancing. Does this work for Cryptos? I explain why you should rebalance Cryptos and why this may change in the future.

Let’s say on January 1st, 2017, you built a random 8-coin Crypto portfolio allocating $1000.- each. A gutsy decision, given that BTC lost already 90% and then again 80% of its value.

Random Crypto portfolio selection 1. January 2017. Source: Felix Gasser

Random Crypto portfolio selection 1. January 2017. Source: Felix Gasser

These are random picks but with all the hallmarks of Cryptocurrencies including exponential run-ups, 90% losses, fat-tailed stochastic price action, and dependencies in the extremes. A perfect lab to test Buy & Hold (B&H) versus Rebalancing (RB). You demonstrate nerves of steel and never touch the portfolio for over 1500 days resulting in a perfect Buy & Hold performance result.

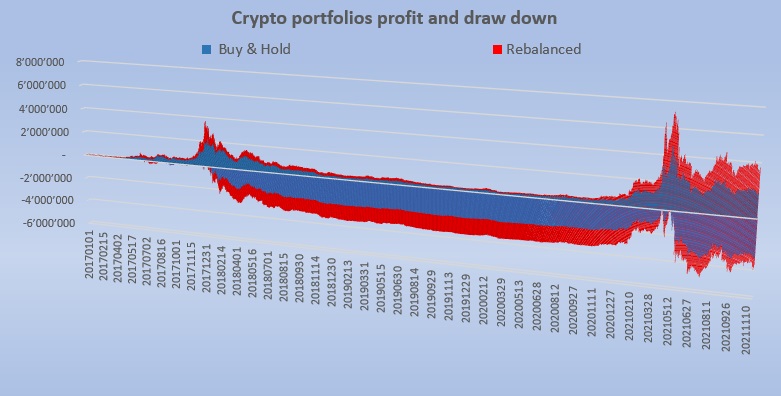

21. Nov 2120, another random date, the portfolio shows a value of over $1.8 Mio returning a whopping 22’000%, supporting “Hodler” consensus favoring B&H. Is B&H the strategy to filter a winning lottery ticket from a random stack? At closer inspection though, risk numbers of the portfolio look truly horrific, and frustration is guaranteed.

Not the institutional touch, if that is what you are looking for. 95% of the time underwater. Source. Felix Gasser CSI-Data

Is this an invitation for institutions to add value with RB? Remember financial theory assumes stochastic price paths iid resulting in normal return-distributions and RB springs from the same MPT toolbox. Will the same benefits apply to super non-normal distributed Crypto portfolios or may lottery mathematics rather apply?

RB is a reset of exposures to maintain risk-reward and diversification. Think of it as profit-taking and redistributing. Results indicate that larger return spikes produce more performance from RB. Is this an easy money-making scheme? Careful! This works under the assumption, that most coins repeatedly produce excessive return peaks. Something we do observe in the early Crypto universe, but potentially less in the future, reducing the RB impact.

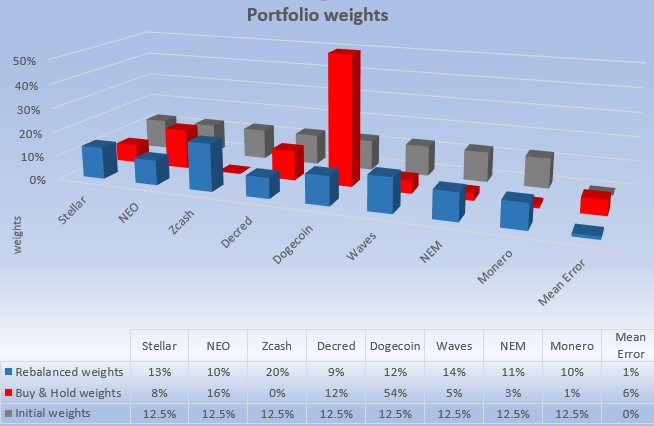

RB quarterly 17 times to equal dollar, controls weights to 1% mean error.

B&H produced exposure distortion with a 54% risk concentration. Source: Felix Gasser CSI-Data.

Graph 1 Weights show the intended favorable exposures after RB, equalized in favor of Monero, Zcash, compared to B&H with a lump-sum risk of 54% in Dogecoin. Volatilities fluctuate between flat-lining to extreme outliers, hampering algorithmic risk comparisons. For this reason, I used an equal capital method for RB. To account for spreads and fees I allowed one day for trading using execution prices of the next day.

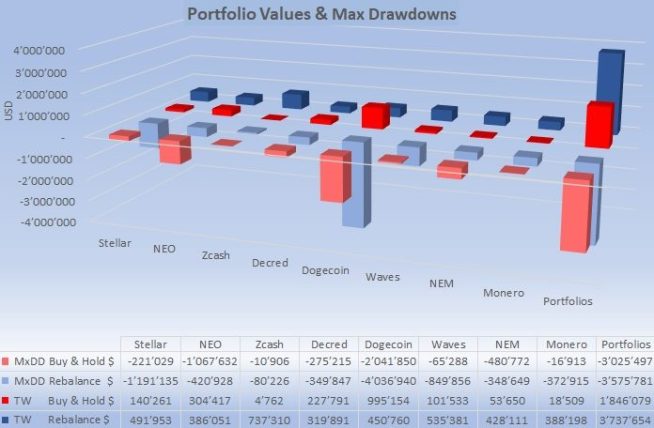

Equalized exposures through RB allow for more return compounding.

MxDD remains high because all coins produce over 90% MxDD individually.

Source: Felix Gasser using CSI-Data.

Graph 2 visualizes how equal exposures compound more absolute values for the RB portfolio. Cryptocurrencies move correlated, but they deviate in return magnitude. To capture these randomly distributed individual windfall spikes, equal weights prove to be favorable.

The only caveat is the MxDD remains high. So, what’s the point of RB? Despite inherently large drawdowns the RB portfolio has superior return metrics:

It may feel counterintuitive, but results indicate RB is particularly suited to capture returns of turbulent Cryptocurrencies, also when Bitcoin and Ethereum are added. But there is a catch. RB is a profit-taking system. The more investors take profit the sooner price spikes are capped. This arbitrage matures the crypto space. The more institutional risk capping, the more returns normalize. For now, periodic RB is commendable and can be coordinated with stacking. If you prefer to freestyle it though, remember you want to RB near performance peaks and since you never know where the top is, you always need luck by your side if you do that.