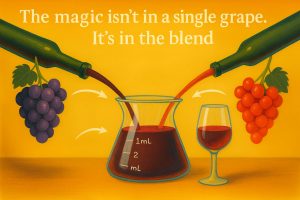

If you’ve ever enjoyed a great Bordeaux, you know the magic isn’t in a single grape. It’s in the blend. Merlot brings the aroma, Cabernet brings the structure, and together they create something richer and more balanced.

The same idea applies to decision-making. Organisations rely on countless dashboards and metrics to guide decisions, but two kinds of insight are becoming especially powerful when combined:

Sentiment Analysis and Prediction Markets.

Sentiment Analysis

is basically AI’s way of reading the newsroom.

It picks up the tone of conversations –

on social media, in reviews, in articles, even inside your organisation.

It can sense whether people are excited, nervous, frustrated, or losing interest, often before your metrics show anything unusual.

It’s the “aroma” of public mood, the early signal that something might be shifting.

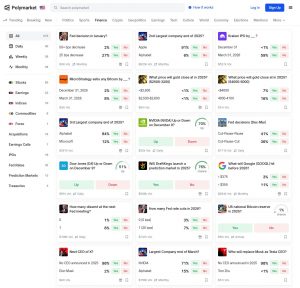

Prediction Markets

Prediction Markets – Finance Dashboard (https://polymarket.com/finance, assessed 09.12.2025)

on the other hand, cut through that emotion.

They ask people to put a stake on what they think will happen:

Will sales hit the target? Will the product launch land well? Will customer churn go up or down?

When people trade on these outcomes, the prices reveal the crowd’s real beliefs – less bias, more honesty, better accuracy.

It’s the structural backbone, the probability layer behind the story.

But here’s the catch: not all prediction markets offer the same quality !

Centralised platforms still rely on trust, human-controlled systems, and potentially biased moderators. That’s where blockchain-based prediction markets elevate the entire vintage:

Running prediction markets on blockchain

is like putting your Cabernet into a perfectly secure, climate-controlled underground bunker –

removing doubt, manipulation, and deterioration.

Smart contracts store funds securely, automate market rules, and execute payouts without human intervention.

Every trade, and resolution is recorded on an immutable public ledger. No silent edits. No censorship. No dependency on a single operator.

This decentralised structure delivers powerful advantages:

- Trustless transparency – participants can audit everything, anytime.

- Tamper-proof settlement – winners are paid automatically and fairly.

- Lower operational friction – no brokers, custodians, or manual oversight.

- Open participation – more traders and liquidity strengthen forecast accuracy.

- Censorship resistance – no authority can quietly edit data, freeze accounts, or shut down the system.

It’s the difference between guessing a wine’s authenticity – and verifying the vineyard, barrel, and bottling records yourself.

And here’s the key: When you combine emotion and probability,

you get a much clearer view of reality !

Sentiment tells you

what people are feeling and why they’re reacting.

Prediction markets tell you

what’s likely to happen next.

When the two line up, you get a strong signal.

When they don’t, you know where the noise is.

There are several ways organisations can blend the two

Sentiment as the aromatic first impression, markets as the structural backbone

Sentiment detects early mood swings, feeding traders’ decisions in prediction markets. In elections, for instance, it picks up post-debate reactions that markets then translate into updated probabilities.

Markets as the tannin-rich reality check

When sentiment becomes exaggerated, prediction markets reveal whether the buzz is meaningful or just noise, helping leaders avoid overreacting to social-media storms.

A full-bodied ML blend

Sentiment offers nuanced features, while prediction markets supply reliable probability labels. Combined, they enable forecasting models that outperform traditional analytics across product performance, markets, and customer behaviour.

Sentiment as early-warning acidity, markets as the decisive finish

Sentiment spots early signs of backlash or enthusiasm, while prediction markets show whether these shifts will truly impact outcomes. After a pricing change, for instance, rising churn probabilities signal action, while steady ones suggest only a vocal minority.

Conclusion

In a world where leaders are expected to make fast decisions with incomplete information, this kind of blended intelligence is becoming a real competitive advantage.

It’s not just about knowing the numbers. It’s about understanding the story behind the numbers – and the probabilities behind the story.

It’s the modern version of a Grand Cru: expressive, structured, and far more powerful than either ingredient alone.

If your organisation is exploring new ways

to forecast, sense risk early, or simply make better strategic decisions,

please check out this blend of sentiment and prediction markets:

It might be the most balanced intelligence “assemblage” you’ve ever tasted.

This blog post was created with the support of ChatGPT.

References

The cover image was created by ChatGPT based on the following images:

|

|

|

|

|

|

|

|

Additional Resources

Sentiment Analysis

https://en.wikipedia.org/wiki/Sentiment_analysis

https://www.ibm.com/think/topics/sentiment-analysis

https://docs.cloud.google.com/natural-language/docs/analyzing-sentiment

https://docs.aws.amazon.com/comprehend/latest/dg/how-sentiment.html

Prediction Markets

https://en.wikipedia.org/wiki/Prediction_market

Today, the two leading prediction market platforms by trading volume and liquidity are Polymarket and Kalshi:

Polymarket is a leading global prediction market built on blockchain technology, offering fast, transparent trading on a wide range of real-world events enabling real-time crowd forecasting across politics, finance, culture, and more.

Kalshi is a U.S.-regulated, centralised prediction-market platform, where users trade event contracts on real-world outcomes like economic data or political events. Unlike blockchain-based markets, Kalshi operates as a traditional exchange under CFTC (Commodity Futures Trading Commission) oversight, offering a structured way to express forecasts or manage real-world risks.

In Switzerland, Polymarket is classified as an unlicensed online money-gaming service under the Swiss Money Gaming Act and is therefore blocked by the national regulator GESPA (Swiss Gambling Supervisory Authority). Kalshi, on the other hand, is not on the Swiss blocklist. While neither platform is licensed to offer services in the Swiss market, individual users in Switzerland are not prohibited from accessing or using them, under Swiss law.