The value of money seams to be an old secret as the USD lost more than half of its purchasing power every 30 years. Funnily enough, the broad public has only dealt with that question since 2010. Here is a short view of the value of things from another perspective.

You can never solve problems with the same mindset that created them. – Albert Einstein

Since 2020 the public community that questions the value of money has rapidly grown. I ask myself this question all the time. In doing so, I always find that I see the world through different eyes than my friends. Here are a few statements of the current prosperity through my eyes:

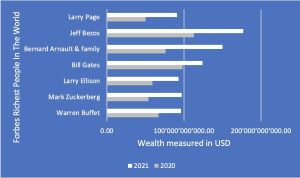

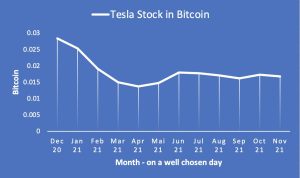

- My Tesla stocks have lost 41% of their worth in 2021

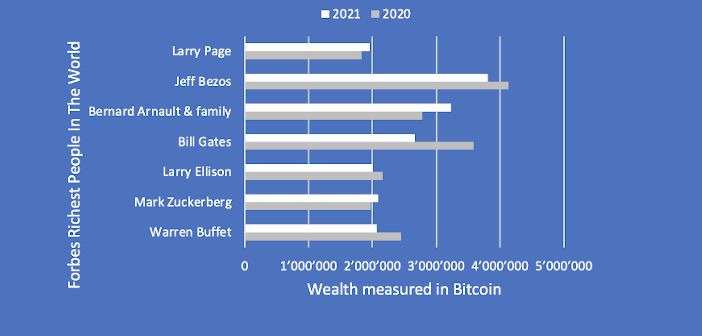

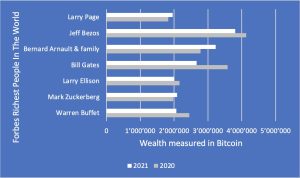

- The wealthiest people in the world lost almost no part of their wealth in 2021

- The middle class has lost part of their fortune in 2021

- Saving money will not make me richer

- As a middle class, I earn less and less every year

- Everyday goods became massively cheaper in 2021

- Printing money takes wealth from the middle class to distribute

- to those affected by crises,

- to location promotion and

- to the rich.

To give you a better understanding of my view of the world, I created the following graphics.

To the attentive observer, I must confess that for my graphs I used the Bitcoin USD rates that best fit my statement, with an accuracy to the month.

How much something is worth is always in the hands of the viewer. When we measure the world by the USD, we forget that the USD is not stable in value, that it is only one of many possible benchmarks for prosperity, and that we can only measure our own prosperity by our own basket of goods. When we hold USD, we often forget that it loses value over time and is just one of many other liquid assets. While Bitcoin is probably not a good reference for your shopping cart, it is a good one for mine, which consists mostly of other cryptocurrencies and tech companies. When I look at the price changes of other cryptocurrencies compared to the USD, I can never tell if it’s because of market volatility or because the cryptocurrency is changing its value compared to some fundamental beliefs. But let us take an example that is probably in your shopping cart. Who does not want to own his own property one day? When you compare your property to the USD, you can never tell if the property is just constantly increasing in value or if it might just be holding its value compared to similar assets. It’s also hard to tell when the market is undervalued and when it’s overvalued. And even if you save a portion of the USD each year, the value of the property you want to buy is likely to increase more each year than the USD you can save.

With better references than the USD, we could make the natural interpretation of the markets more accurate. I would imagine that for assets in general, the NASDAQ-100 might be a good reference. Or for the general public, an inflation-adjusted USD. For me, it’s bitcoin with all its pros and cons. Let’s take a quick look at what actions this triggers in my daily life:

- The prices of everyday goods are very volatile. But whenever they are expensive, the USD is high in value compared to bitcoin. So, I better buy my daily necessities with a USD loan, which charges almost no interest anyway.

- If rent and daily necessities are worth little compared to Bitcoin, I pay for them directly from my savings.

- Since USD as an asset (like other fiat currencies) has depreciated greatly over the years, I try to hold USD only in small amounts and for as short a time as possible.

- And like a commuter who works in one country with one currency and lives in another with another, I consider myself an expert on when my home currency is overvalued and when it is undervalued.

I hope after giving you a glimpse into my view of life, you start to question your trust in money as a store of value (for savings) and find your own solution to the problem, maybe a more practical and less risky one than mine.

Here are the same graphs in USD, designed by me; figures from Forbes and from Google Finance.