Corporate actions affect issuers and investors of securities. These include dividends, rights or votes. Investors expect them as basic banking services. Behind however, an industry of 200’000 people evolved! Error-prone processes cause USD 1.3bn losses as consequence of intermediary-chains, ambiguous communication and missing standards. All this making it a great opportunity for tokenization and DLT.

The purpose of Corporate actions

Investors expect the ability to easily access and act upon up-to-date information and payments concerning their assets. Events can be mandatory or voluntary, where mandatory events do not require action from investors (e.g. cash dividends, stock splits, mergers), and voluntary events require investors instruction (e.g. optional dividend, tender offer, rights, general meeting votes).

The involved players

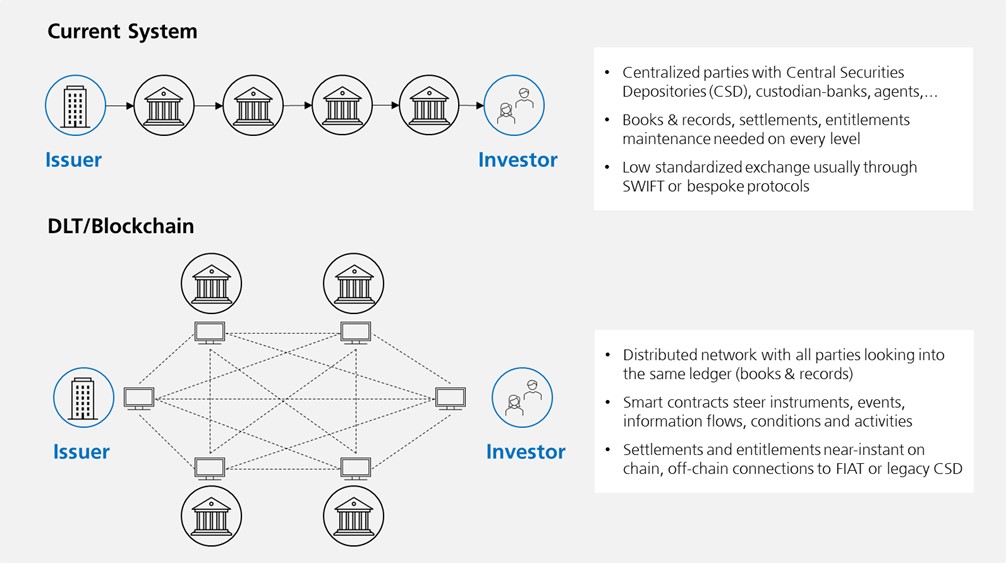

Corporates or Institutions are issuers of debt and equity securities. The terms of securities are defined during issuance, usually 50+ pages legal papers. Issued securities are registered with Central Securities Depositories (CSD) and agents might be appointed for calculations or payments.

Investors keep assets with banks, that in turn hold them with a CSDs or indirectly through sub-custodians. On each level, custodians run own books reflecting settlements out of trading, transfers or lending.

The daily hassle to get it right

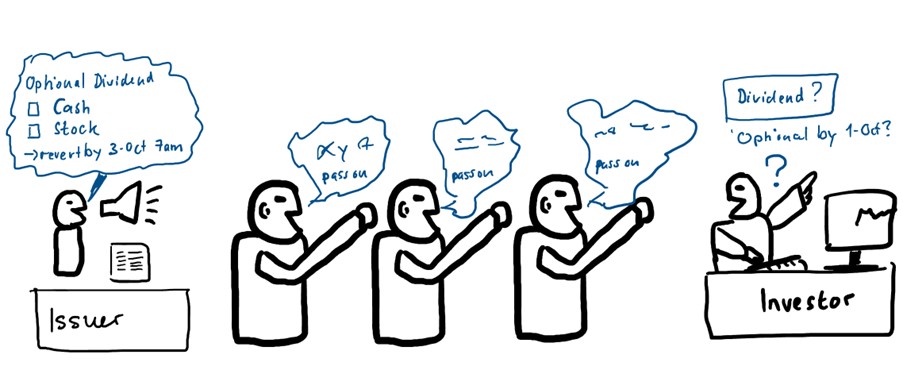

The process starts with an issuer announcing events. A cascading chain of intermediaries receive, cross-check against other data providers and release information to next party. In extreme cases players even screen newspapers to ensure full coverage.

To be eligible for events, investor’s positions need to be in the custodian’s entitlement calculation on time and this has to include pending or unsettled positions.

For voluntary events, investors need to be notified early in the process to be able to submit their choices on time. Aggressive issuer deadlines make timely processing essential.

Finally, elections and payments are being exchanged through the chain. Obviously with widespread interpretation disputes and errors that led to industry-wide inefficiencies. And no surprise, risks and costs are ultimately born by investors and issuers.

Imagine investors and issuers are running on the same ledger

The evolution of DLT and tokenization of securities could be game changing. For securities issued on DLT, smart-contracts provide single point of reference for terms, data and rules. Issuers and investors interact directly on the same ledger. All without middle men and avoiding things like:

- intermediary with own books and records

- multiple levels reconciling positions and entitlements

- parties disputing interpretation of rules or deadline

and you can also reimagine:

- advices, elections, votes and payments run immediately and directly

- regulators, auditors or tax authorities get bespoke insights enabling automation for example in tax claims

The outlook

Projections suggest tokenized assets could grow to 24 USD trn by 2027. Beside automation in corporate actions, benefits include liquidity, fractionalized access and instant settlement.

However, network effects are yet to come along maturing regulations, standards and ecosystems. McKinsey called it co-opetition paradox, collaboration between competitors is important to get solutions out of sandboxes.

With corporate events poised to increase in complexity with programmable securities, properly managed and flexible smart contracts will be key in the new corporate action world. Whilst challenging, this paves way for innovative new features such as loyalties or ESG-conditions.

Short-term improvements are running with DLT solutions such as smart contracts mastering event data and triggering activities already being applied for traditional securities.

Even if intermediaries were here to stay on the last mile rather than fully eliminated, to have all players looking into the same (distributed) ledger will be revolutionary itself.

Further interesting reads…

- Deloitte on Disruption in asset servicing

- Deloitte – are token assets securities of tomorrow

- WEF Digital Asset DLT and Future of Capital Markets

- Accenture – The Maze Corporate Actions

- ISSA – Crypto Assets Moving to Practice

- ISSA – DLT Report

- Consenys – Advancing Capital Markets with Blockchain

- HSBC – Potential of Tokenization

- BNP – Major Stock Exchanges with DAML smart contracts