Since the decentralized exchange (DEX) „UniSwap“ became live in 2020, people can provide their own assets as liquidity on DEX to earn a reward – so-called liquidity mining. However, new DeFi (short for decentralized financing) projects need huge investments to attract enough liquidity. Olympus DAO has developed a novel liquidity concept which is referred as a representative concept for DeFi 2.0.

High costs for liquidity

Automated market maker protocols (AMMs) use smart contracts to create liquidity pools. Anyone who wants to make a new coin or token exchangeable on a decentralized trading platform must provide rewards for liquidity providers. These liquidity mining costs can be huge when it comes to not just a token, but a new decentralized trading platform or eco-system. The following table shows the scope of such incentive programs:

|

Blockchain |

Avalanche |

Solana |

Fantom |

Celo |

Harmony |

|

Incentive Program |

180 M. $ |

100 M. $ |

296 M. $ |

100 M. $ |

300 M. $ |

The incentive programs that attract new users with generous token rewards have an undesirable side effect – namely increased inflation of the corresponding token. The more generous the program is, the more coins and tokens are available on the market afterwards. Furthermore, the generated liquidity usually has no loyalty to the token. They flow out as soon as the price of the token begins to drop. Scarce liquidity in turn leads to high slippage, which pulls the price down further. Thus, a negative spiral is created.

Is there a concept where you don’t need excessive capital for a „cold start“ and can keep the gained liquidity when you need it? Olympus v2 (OHM) has developed a concept for DeFi projects to solve the liquidity problem. Therefore, Olympus v2 is often referred as the representative project of DeFi 2.0.

The approach of Olympus DAO

Olympus was originally developed as a concept for Stable Coins. The basic idea is:

- liquidity should be created during token generation, not afterwards.

- the protocol itself should own and manage the liquidity to reduce dependencies on external liquidity providers.

These two ideas are realized by so-called „bond“ mechanisms. For example an OHM token can only be regenerated if either:

- OHM-ETH liquidity pair or

- DAI (a stable coin)

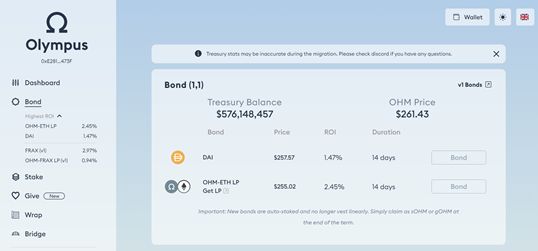

is paid into the protocol. 14 days after the deposit, new tokens are generated and transferred to the buyer. Usually, the paid-in liquidity is lower than the market price of the token, therefore it is called as a „bond“. This mechanism is referred to by Olympus DAO as (1, 1), see image below.

The other way to own OHM tokens is of course to buy the tokens directly on an exchange. In this case, no new tokens are created, only the owner of the tokens has been changed.

Bonds-as-a-Service

In the form of „Bond“, Olympus DAO also offers services to other projects who want to own liquidity for their own tokens. This protocol with Bonds-as-a-Service or Liquidity-as-a-Service is called Olympus Pro, see screenshot below:

Value appreciation and the risk of OHM token

OHM tokens can be staked. In this case, OHM tokens are replaced by sOHM in the wallet. The staked tokens increase every 8 hours by a so-called „rebase“ mechanism. Rebase means that the number of total supply of the tokens changes by a percentage. In principle, the percentage can be either positive or negative, but for sOHM this percentage is always defined as positive. Therefore, supply of sOHM is an exponential function upwards.

Assuming no OHM token is sold from a point in time, the last price remains valid. However, the amount of sOHM becomes larger over time due to the rebase mechanism, thus total market capitalization of OHM increases exponentially upwards. The value of all OHM tokens is higher than the value that was paid in when they were created. At the time of writing this blog post (on 09.01.2022), „Total Value Deposited“ is at 604 million USD, but „Market Value of Treasury Assets“ is at 1’838 million USD.

This increase in value continues as long as the same amount or more money flows into the protocol (through purchase or bond) than flows out. This means that if all participants have great confidence in the DAO, almost all tokens will be staked but hardly sold. In that case, the asset grows exponentially – at least on paper. This effect is denoted by (3, 3) in Olympus DAO.

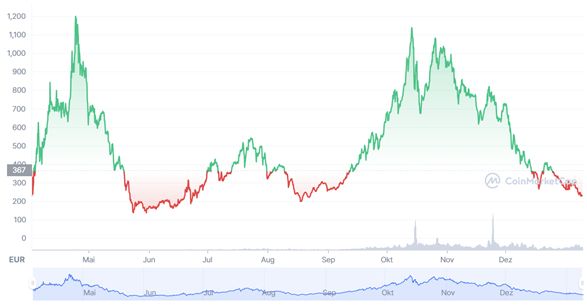

However, if more OHM tokens are sold than money flows in, the increase in value has to be quickly corrected. Since major part of the tokens were staked, participants will always have more tokens than before due to rebase. But the liquidity pair was set up with the original amount of OHM tokens. Therefore, the correction causes very often a chain reaction downward and forms a reverse exponential curve in the chart, see picture above.

When someone not only uses the liquidity concept of Olympus DAO, but also invests in OHM tokens, one must always pay attention to the real value owned by the protocol and market value of the token. If the token is highly overvalued, sooner or later the price has to come back to the real value, even if the APY seems to be very high. One must always be aware of this risk!

Related links to the topic (optional)

- Official website of Olympus DAO: https://www.olympusdao.finance/#/

- Bond-as-a-Service by Olympus Pro: https://pro.olympusdao.finance/#/bond

- Top DeFi 2.0 projects: https://www.coinspeaker.com/top-defi-2-0-projects-ohm-time-brc/

About Author

Cheng Ni is a system architect at a medical device manufacturer and blogs from the CAS Crypto Finance and Cryptocurrencies class. He is passionate about helping more people navigate and profit in the decentralized world. He has studied computer science, has a PhD in virtual reality from the Fraunhofer Institute, and does crypto mining and DeFi liquidity mining as a hobby.